The Money Matters Mindset – Shifting Your Thinking to Achieve Financial Freedom

Often, individuals question their retirement. Some feel frustrated, scared, or confused about whether they are on the right track to attain the freedom to live the life they've always desired.

You might find yourself aiming for financial independence – a lifestyle that liberates you from financial worries and the dependence on a salary or business income. In this life, you can relish a reliable and ongoing cash flow from a well-diversified investment portfolio, providing a steady income to meet all your lifestyle needs, both in the present and for the future.

STEP 1 – PERSPECTIVE

Adopt a New Mindset and Cultivate a Healthier Relationship with Your Wealth.

Our outlook on money, wealth, and retirement is often shaped by our upbringing and early financial experiences. The emotional connection we have with money can pose significant hurdles to developing a healthy financial perspective. Recall your earliest encounters with earning money. What financial principles did your parents instill in you? How did you feel when you experienced financial setbacks or achieved major milestones like purchasing your first home or supporting your children through college?

Many individuals harbour a fear of insufficient resources. Nearly three in ten Canadians lack confidence in achieving their financial goals (28%). This apprehension may stem from childhood memories of financial hardship or moments of shame or embarrassment. The initial step is recognizing this mindset and transitioning from a mentality of scarcity to one of abundance.

A prosperous mindset perceives money as a facilitator. It regards money and wealth as tools that empower you to lead the life you desire and alleviate financial stress. Nevertheless, wealth alone does not guarantee happiness; it necessitates the cultivation of an abundance mindset. Remember, wealth should not be equated with success but viewed as a means to attain more and potentially superior choices. The manner in which you utilize your wealth is ultimately your decision. Will you prioritize amassing material possessions, or will you opt for a simpler existence enriched by love, meaningful relationships, and enriching experiences such as travel? If the latter appeals to you, recognizing money as an enabler of your freedom and lifestyle represents a crucial initial step.

HERE ARE A FEW COMMON “UNHEALTHY” PERSPECTIVES THAT I’VE HELPED MY CLIENTS OVERCOME, TO ENJOY A HEALTHIER, MONEY MATTERS, MINDSET

Overcoming the Fear of Risk-Taking

Many people are more driven by the fear of loss than the pleasure of winning. However, constantly choosing the path of least resistance can ultimately hinder us from achieving the goal of financial independence. To cultivate a prosperous mindset, it's essential to pursue opportunities where the potential for positive outcomes outweighs the risks of negative ones. While some loss is inevitable, the probability of success is often higher than that of failure. Developing the ability to take calculated risks early in life can foster confidence and resilience, enabling us to make wiser decisions and achieve better results as we grow older.

The Pitfalls of Overconfidence

People tend to feel more assured in areas where they have some familiarity, avoiding those that seem unknown or uncertain. This natural fear of the unknown can sometimes backfire, as a little knowledge can breed overconfidence. For instance, I once encountered an investor deeply entrenched in the oil and gas industry. Believing he had superior insights into this market, he made substantial investments and even borrowed money to amplify his bets on junior oil and gas companies. Unfortunately, he overlooked broader geopolitical and macroeconomic factors that influenced oil prices in unexpected ways. His overconfidence led to significant losses, costing him hundreds of thousands of dollars. Seeking help, he approached me, and together we rebuilt his portfolio, diversifying into sectors and asset classes he had previously ignored. Over time, he recovered his losses and now enjoys a work-optional life.

The Dangers of Fixation

Many investors fixate on the price they initially paid for an asset, refusing to adjust their position until they can sell at or above that price. I once had a client who planned to sell his house in 2016. Vancouver's housing prices had been on a steady rise, peaking in 2016, with a widespread belief that "Vancouver housing prices would always go up." Despite receiving a very strong offer that year, he held out for a higher price. As the market cooled and prices declined over the next few years, he remained fixated on the peak price he was offered in 2016. His mindset was stuck on the potential profit he missed out on, rather than adapting to the current market conditions. By not selling and reinvesting in a portfolio of income-generating assets, he missed an opportunity to enhance his financial stability and move towards a work-optional life.

STEP 2 – PLAN

Develop a Financial Plan and an Investment Plan tailored to your life.

The objective is to create both a Financial Plan and an Investment Plan, ensuring they are aligned and complement each other. In my experience, most investors have either one or none, seldom both. The Financial Plan defines the necessary steps to reach your goals, while the Investment Plan details the strategy for executing those steps. Having both plans is essential for effectively navigating the journey to financial success.

Financial Plan

Research from the Financial Standards Council of Canada highlights a significant correlation between engaging in financial planning and experiencing higher levels of both financial and emotional well-being among Canadians.

While attempting to formulate a Financial Plan independently is an option, seeking assistance from a professional offers the advantage of expert guidance tailored to this process.

The journey begins with envisioning your future – picturing how it will look and feel. From there, you estimate the monthly or annual cash flow required to sustain this lifestyle realistically.

You then calculate the necessary balance in your investment portfolio to generate and maintain this cash flow reliably. Working backward, you determine the current saving and investment targets to reach the desired portfolio size capable of supporting your future.

These steps outline the foundation of a Financial Plan. However, a Comprehensive Financial Planning process extends beyond, encompassing additional facets like insurance planning, tax and estate planning, and targeted goal planning such as funding your children's education.

Investment Strategy

I've witnessed firsthand the volume of investment strategies and their varying degrees of efficacy. However, one consistent truth remains: every investor requires a robust Investment Plan that they can faithfully adhere to.

Through years of observation and analysis, I've identified a method that stands out for its reliability and effectiveness. Unlike conventional strategies driven by anecdotal narratives or speculative market instincts, this approach is firmly grounded in a disciplined, structured methodology rooted in financial science.

STEP 2 – Professionals

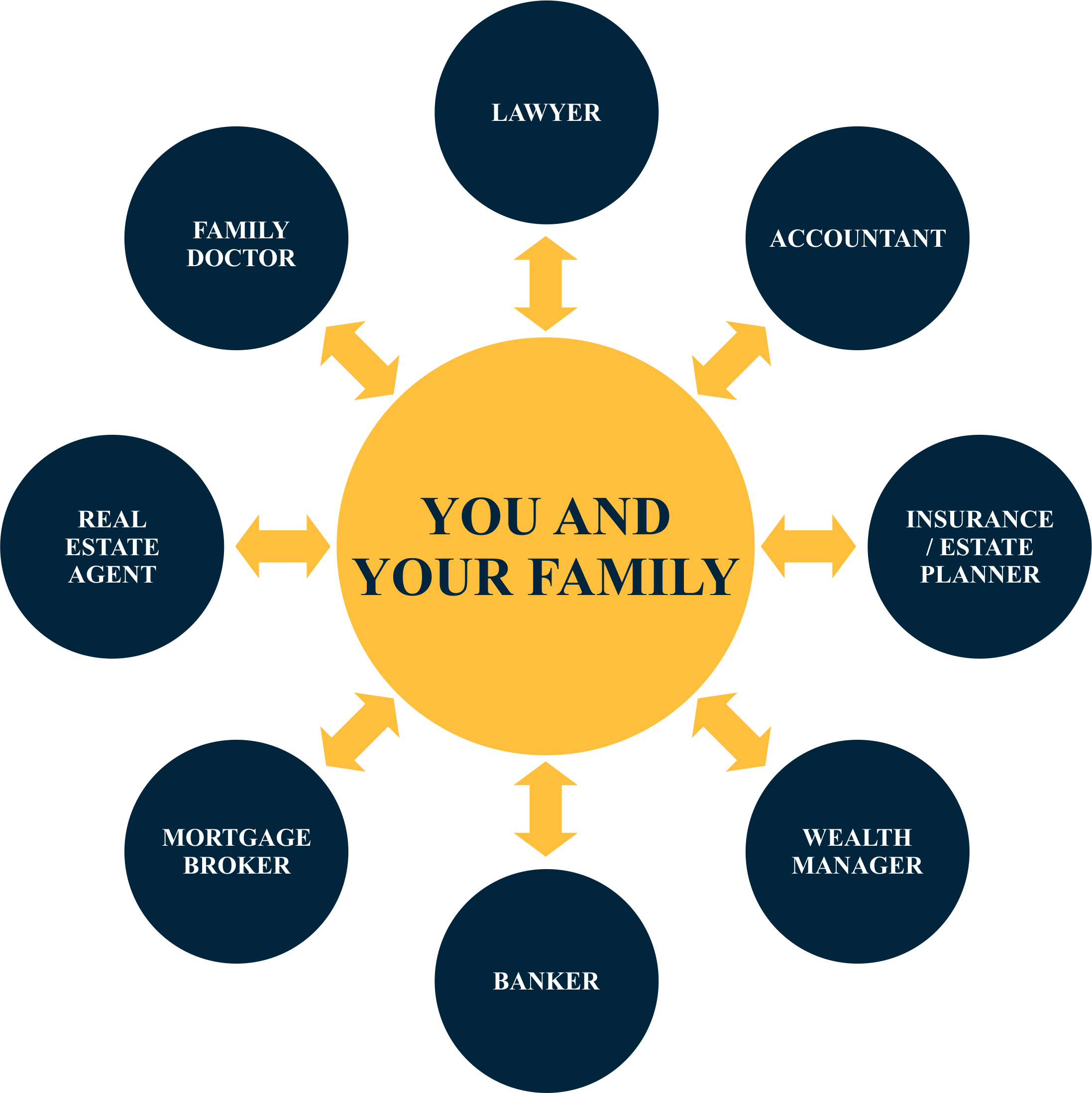

Surround yourself with professionals.

While some Canadians manage their finances independently, a significant 65% of Canadians over the age of 50 have opted to engage a professional financial advisor. Research from the Montreal-based Centre for Interuniversity Research and Analysis on Organizations reveals that individuals who seek professional financial advice witness their assets grow over time at a rate 1.58 to 2.73 times higher than those who navigate the financial landscape solo. To ensure a path towards a financially secure retirement, it's crucial that this financial advisor possesses both expertise and experience, prioritizing your best interests.

A prime illustration of the importance of surrounding yourself with the right individuals emerges during periods of extreme market volatility. Amid the recent global COVID-19 pandemic, a startling statistic emerged from a Fidelity study: 1 in 5 investors succumbed to panic and hastily sold off their investments between February and May 2020, consequently locking in losses.

In times of heightened market turbulence, the presence of a professional financial advisor becomes exceptionally invaluable. Their guidance serves as a beacon through the emotional haze and fear, steering you away from impulsive decisions. A skilled advisor's role extends beyond mere financial advice; they aid in cultivating a resilient mindset, preventing panic-driven sell-offs and encouraging continued investment to ride out market recoveries.

It's paramount to invest in assembling a trusted group of individuals or advisors. These individuals play a pivotal role in fostering sound financial thinking and behaviour, providing support and guidance to navigate challenging market conditions effectively.

Qualities to Seek in Your Ideal Financial Advisor:

Expertise

Find an advisor whose credentials reflect proficiency and unwavering ethics, such as the esteemed Chartered Financial Analyst (CFA) designation, recognized globally in the investment realm. Seek out an advisor committed to acting in your best interests rather than one driven solely by product sales for commission. Choose a financial advisory firm equipped with cutting-edge technology and structured investment processes to safeguard your wealth amid market fluctuations.

Transparency

Select an advisor known for their integrity and transparent communication, offering clarity regarding your investment strategy. This transparency instills confidence in your financial plan, enabling you to understand necessary adjustments for steering towards your desired financial goals, including achieving a work-optional lifestyle.

Alignment with Your Goals

Engage an advisor who invests time in comprehensively understanding your financial objectives, values, and attitudes toward wealth. This alignment empowers you to pursue financial freedom with confidence, ensuring that your advisor supports you in achieving outcomes that resonate with you personally.

Long-Term Vision

Partner with an advisor who prioritizes your future prosperity. Look for someone capable of crafting multi-generational plans, devising business succession strategies, and facilitating philanthropic endeavours. This ensures continuity in your financial journey, granting you the peace of mind you deserve across generations.

Follow these 3 key steps to help you think differently, and shift to a healthier money mindset.

Perspective

Plan

Professionals